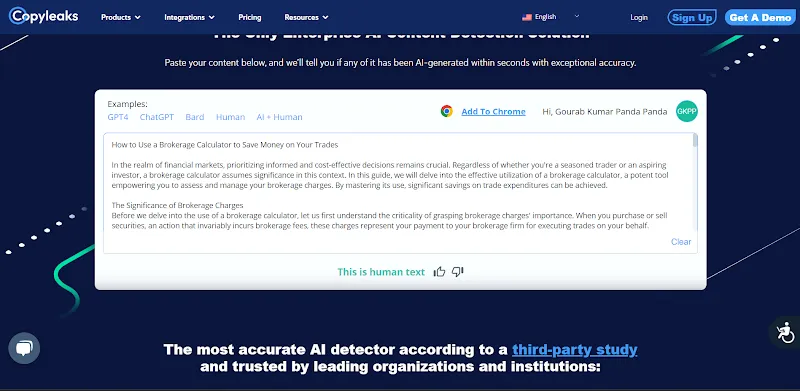

In the realm of financial markets, prioritizing informed and cost-effective decisions remains crucial. Regardless of whether you’re a seasoned trader or an aspiring investor, a brokerage calculator assumes significance in this context. In this guide, we will delve into the effective utilization of a brokerage calculator, a potent tool empowering you to assess and manage your brokerage charges. By mastering its use, significant savings on trade expenditures can be achieved.

The Significance of Brokerage Charges

Before we delve into the use of a brokerage calculator, let us first understand the criticality of grasping brokerage charges’ importance. When you purchase or sell securities, an action that invariably incurs brokerage fees, these charges represent your payment to your brokerage firm for executing trades on your behalf.

Your broker, the type of securities you trade, your trading volume, and other factors can significantly vary the level of brokerage charges. These high fees have the potential to erode your profits; therefore, a robust comprehension of their operation is crucial for minimization.

Also Read : Choosing The Perfect Pants For Any Occasion A Guide To Elevate Your Style

What is a brokerage calculator?

A handy online tool called a brokerage calculator aids in estimating the cost of your trades. You can input various trade-related parameters, including the type and quantity of securities, buy and sell prices, and other pertinent information. In response to these inputs, the calculator generates an estimate for expected brokerage charges.

A brokerage calculator primarily serves to offer transparency; it equips you with the necessary tools for making informed decisions about your trades. This resource proves invaluable: not only does it allow traders and investors to optimize their trading strategies, but it also critically aids in cost minimization.

Also Read : Climbing Mount Blackburn

Using a Brokerage Calculator

1. Choose a Brokerage Calculator:

Begin your process with the selection of a reliable brokerage calculator tool; numerous financial websites and trading platforms provide these calculators at no cost. By conducting an online search or perusing your broker’s website, you can locate one effortlessly.

2. Input Trade Details:

Once you have access to a brokerage calculator, begin by inputting the relevant trade details.

Type of Security: Specify whether you are trading stocks, bonds, options, futures, or any other financial instrument.

Quantity: Enter the number of securities you plan to buy or sell.

Buy Price: Input the price at which you intend to buy the securities.

Sell Price: Enter the expected selling price for your trade.

Brokerage Percentage: This is where you input your broker’s brokerage percentage or charge structure. It’s essential to be accurate here, as different brokers have varying fee structures.

3. Calculate Brokerage Charges:

After entering all essential trade details, activate the “calculate” or “estimate” button. The brokerage charges calculator shall generate an estimate of your brokerage charges according to the furnished information. This will help you to know how much it will cost you for the trades that you are going to take. You might think it is of no value, but trust the process, as it is going to show you all the true colors of trading when you realize how it matters.

4. Analyze the Results:

Examine the computed brokerage charges; understanding the costs linked to your trade is imperative. This insight proves invaluable when fine-tuning a trading strategy or evaluating the potential profitability of an individual transaction, thus providing a significant advantage in financial decision-making.

5. Optimize your trades:

Now that you possess knowledge of your estimated brokerage charges, you can make decisions with increased awareness. You have the option to alter trade parameters, for instance, the quantity of securities or entry and exit prices, in a bid to reduce your overall brokerage costs. Also, it varies, as there are options for multi-trade when you are looking for high-quantity trades. So here, it will give you the esteemed value of your quality trades before even starting to trade, but as you get through the process, you will love it more.

Benefits of Using a Brokerage Calculator

Transparency of Cost: This concept ensures you gain a lucid comprehension regarding the potential costs linked to your trades, thereby eliminating any surprise charges.

Cost Reduction: You can estimate and analyze brokerage charges to make adjustments in your trading strategy to minimize costs and boost profitability.

Informed Decisions: You can make informed decisions when planning and executing trades, ultimately leading to better financial outcomes, with the empowerment of a brokerage calculator.

Optimizing Trade Parameters: Utilize the calculator’s insights to optimize your trade parameters; these may include, but are not limited to, the quantity of securities and entry/exit prices. This will enable a more cost-efficient approach.

Comparing Brokers: Considering a switch in brokers? Utilize the brokerage calculator to compare potential costs among various firms; this will assist you in selecting the option that offers optimal cost-effectiveness. Comparing brokers might save you a lot of money, but I will suggest you choose a broker who has a good interface, and not less broker charges, as, in the long term, you might be saving a lot of money on charges but losing it all in the market.

Advanced Features in Brokerage Calculators

Advanced features, catering to specific trading scenarios, are offered by many brokerage calculators. These encompass options for computing taxes, transaction fees, and other potential costs that might apply to your trades. Exploring these features is crucial to obtaining a comprehensive understanding of all your overall expenses.

Conclusion

Every penny saved on brokerage charges in the financial market world adds to greater profits; therefore, employing a brokerage calculator is an effective strategy for managing and minimizing these costs. By inputting your trade details and analyzing results, you can not only make more informed decisions but also optimize your trading strategies; this ultimately saves money on each transaction, which is indeed a powerful tool! Whether you identify as a seasoned trader or are just beginning your journey, I urge you to consider incorporating a brokerage calculator into your array of financial tools. This modest action could yield substantial cost savings and propel you toward fiscal success.